This guide, including the FAQs below, is designed to help you understand your Rhode Island health insurance options and the financial assistance that might be available to you and your family in Rhode Island.

Rhode Island has an individual health insurance mandate, which means residents who do not have health insurance in Rhode Island may be subject to a state tax penalty. Rhode Island also created a reinsurance program that took effect in 2020, helping to keep pre-subsidy health insurance premiums lower than they would otherwise be. 1

Rhode Island created its own state-run health insurance exchange – HealthSource RI . Rhode Island residents can use this platform to shop for individual and family health insurance offered by two private health insurance carriers.

HealthSource RI is also among the state-run exchanges that offer small group health insurance for small businesses, and Rhode Island’s exchange also allows eligible applicants to enroll in Rhode Island Medicaid .

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Rhode Island.

Learn about Rhode Island's Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in Rhode Island as well as the state’s Medicare supplement (Medigap) regulations.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Rhode Island.

To sign up for health insurance through the Rhode Island Health Insurance Marketplace (HealthSource RI), you must: 2

So most Rhode Island residents can enroll in coverage through the exchange. But eligibility for financial assistance is a bigger question for most people, and there are a few additional eligibility rules for HealthSource RI subsidies. To qualify for income-based Advance Premium Tax Credits (APTC) or cost-sharing reductions (CSR), you must:

Beyond those basic parameters, qualifying for subsidies through HealthSource RI will depend on your household’s income compared with the cost of the second-lowest-cost Silver plan in your area – which will depend on your age. (In most states it also depends on location, but Rhode Island is all one rating area, so premiums do not vary by zip code). 6

The open enrollment period for health insurance in Rhode Island runs from November 1 through January 31. Enrollments need to be completed by December 31 in order to have coverage effective January 1. 7 (Note that the enrollment dates are potentially subject to change in future years.)

Outside of the open enrollment window, you may still be eligible to enroll or make a plan change if you experience a qualifying life event, such as giving birth or losing other health coverage. And some people can enroll year-round even without a specific qualifying life event .

Rhode Island is one of several states where pregnancy counts as a qualifying life event, allowing an uninsured person to enroll in health coverage as soon as they find out they’re pregnant (in most states, the birth of a baby is a qualifying event, but pregnancy is not). This took effect in Rhode Island in 2023, due to legislation the state enacted the year before 8

Enrollment in Rhode Island Medicaid and CHIP is available year-round for eligible residents.

To enroll in ACA Marketplace/exchange health insurance in Rhode Island, you can:

When you enroll in a Rhode Island health insurance plan through HealthSource RI, you may be eligible for financial assistance that reduces the monthly cost of your coverage (premium subsidies), and possibly also your out-of-pocket expenses (cost-sharing reductions, or CSR). These federal subsidy programs were created by the Affordable Care Act, and eligibility depends on your income and circumstances.

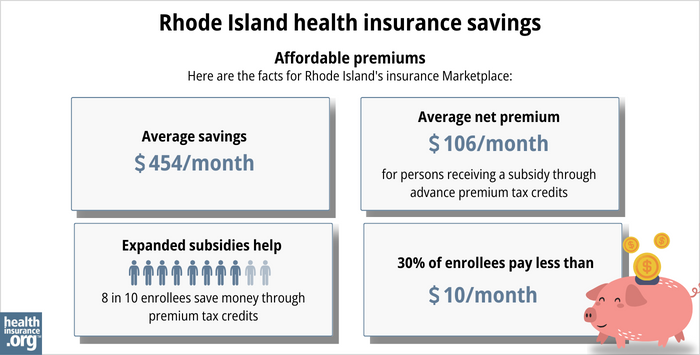

Income-based subsidies (APTC) are available to lower the amount you pay for your HealthSource RI coverage each month. Eighty-six percent of HealthSource RI enrollees were receiving premium subsidies as of early 2024. The subsidies covered an average of $454/month, and reduced the average enrollee’s premium (including those who pay full price) to about $153/month. 9

If your household doesn’t earn more than 250% of the federal poverty level, you’ll also be eligible for federal cost-sharing reductions (CSR) as long as you enroll in a Silver-level plan through HealthSource RI. CSR subsidies will reduce your deductible and other out-of-pocket expenses, making it more affordable for you to receive health care. More than a third of HealthSource RI enrollees were receiving CSR benefits as of early 2024. 9

Rhode Island lawmakers introduced legislation in 2024 that would have created additional state-funded premium subsidies and cost-sharing reductions, but the legislation did not advance. 11 Several other states already offer state-funded subsidies in addition to the federal subsidies that are available nationwide.

Depending on your income and circumstances, you may be able to enroll in free or low-cost health coverage through Rhode Island Medicaid or CHIP. Learn more about whether you might be eligible for these programs.

On the other hand, if you’ve being disenrolled from Rhode Island Medicaid during the “ unwinding” of the pandemic-era continuous coverage rule , you may find that you’re eligible to receive at least two months of premium-free coverage through HealthSource RI. For people in this situation with household income up to 250% of the poverty level, Rhode Island is covering the after-APTC portion of premiums for the first two months. And if your income doesn’t exceed 200% of the poverty level, HealthSource RI will automatically enroll you in a health plan when your Medicaid ends 12 (you’ll still have the option to select a different plan).

As of April 2024, CMS reported that 4,515 people in Rhode Island had transitioned from Medicaid to a Marketplace plan during the unwinding period. Nearly 2,000 of those people had been automatically enrolled. 13

Two insurers offer health plans through HealthSource RI. 14 Both will continue to offer coverage in 2025. 15